Gold Surges to Records as Dollar Weakens Ahead of Pivotal Fed Meeting

By Tredu.com • 9/16/2025

Tredu

Investors pile into bullion on rate-cut expectations and soft dollar, eyeing potential post-Fed upside

Gold prices climbed to new record highs on Tuesday, helped by a softer U.S. dollar and growing confidence that the Federal Reserve will deliver an interest rate cut at its upcoming policy meeting.

Key Drivers: Fed Rate Cuts and Dollar Weakness

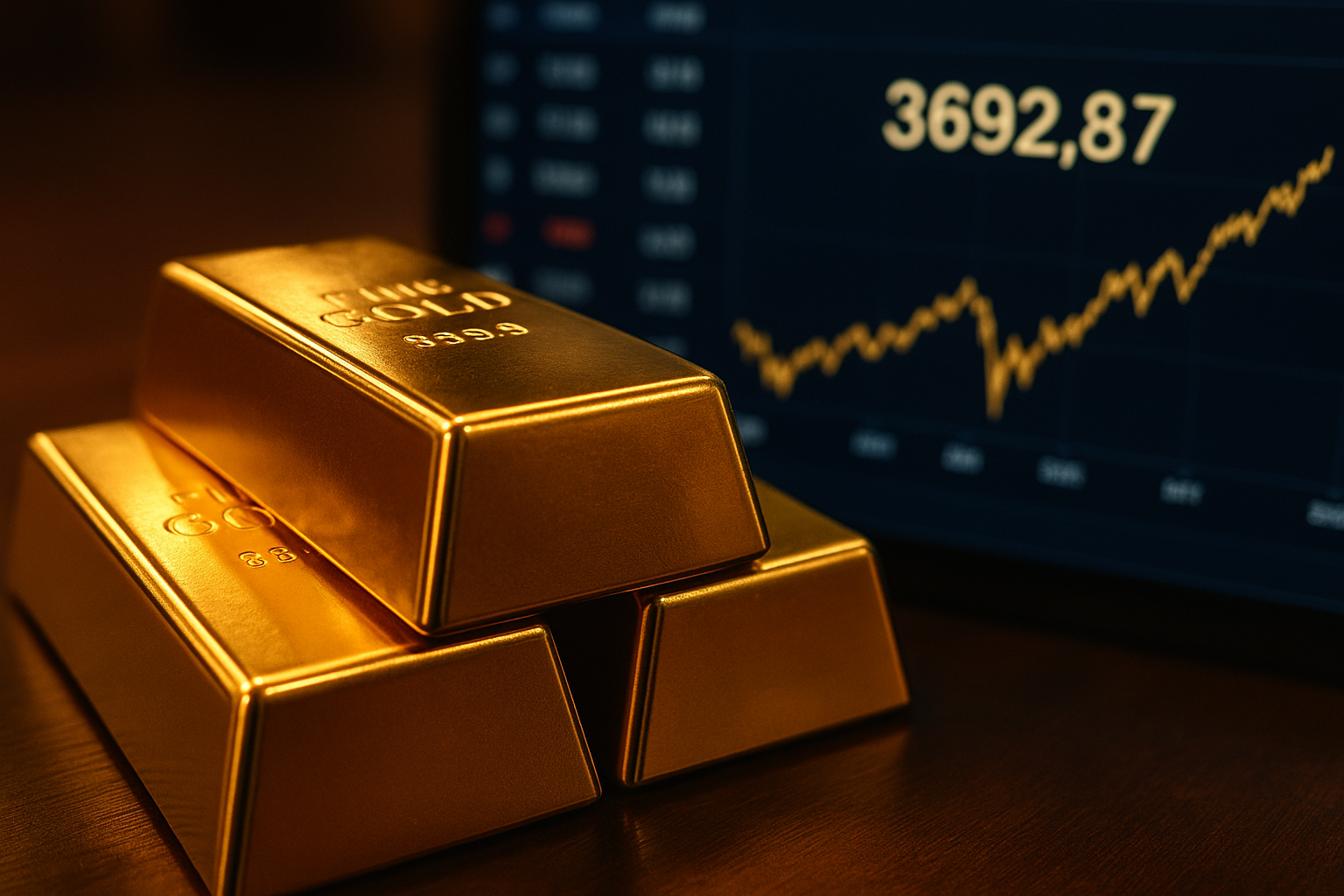

Spot gold rose ~0.4% to $3,692.87 per ounce, after hitting a fresh peak near $3,698.86 earlier in the session. U.S. gold futures for December delivery also rose.

At the same time, the U.S. dollar fell to a more than two-month low versus major currencies, easing pressure on non-yielding assets like gold. Lower U.S. Treasury yields further supported bullion demand.

Market Positioning & Expectations

Traders now widely anticipate a 25 basis-point rate cut from the Fed at the conclusion of its two-day meeting, with a slim chance of a 50 bps cut.

Analysts warn, however, that while gold looks poised for further gains, a short-term correction could happen before it breaks toward $4,000 per ounce in 2026.

Broader Market Implications

- Currencies and FX markets: A weaker dollar tends to boost gold demand globally while putting pressure on U.S. asset yields. Currencies like the rupee, euro, and others may strengthen in this context.

- Inflation & rates: With rate cuts increasingly priced in, policymakers may be more cautious about signaling dovishness if inflation or wage data surprises. Gold’s rise reflects both expectations of easing and concern over inflation persistence.

- Safe-haven demand: Given geopolitical uncertainty (and political pressure on Fed independence), gold is rising as a traditional hedge. Investors in emerging markets particularly may increase exposure.

Risks and What to Watch

- If the Fed signals more hawkish language or fewer cuts than expected, there could be a sharp sell-off in gold.

- Inflation surprises or economic data showing strength could support the dollar and bond yields, undermining the gold trade.

- Supply and demand factors for gold physical and ETFs (including central bank purchases) will matter. Also, regulatory or tax changes might alter investment flows.

In summary, gold’s new highs reflect dovish expectations for Fed policy, a softening dollar, and rising investor fear of inflation or political risk. While upside looks strong, the market may face a correction before 2026. The core theme: falling rates and a weak dollar are fueling gold’s ascent, and markets are keenly focused on how the Fed frames what comes next.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide. Discover proven strategies, risk management techniques, and market insights that will help you navigate the financial markets confidently and successfully.