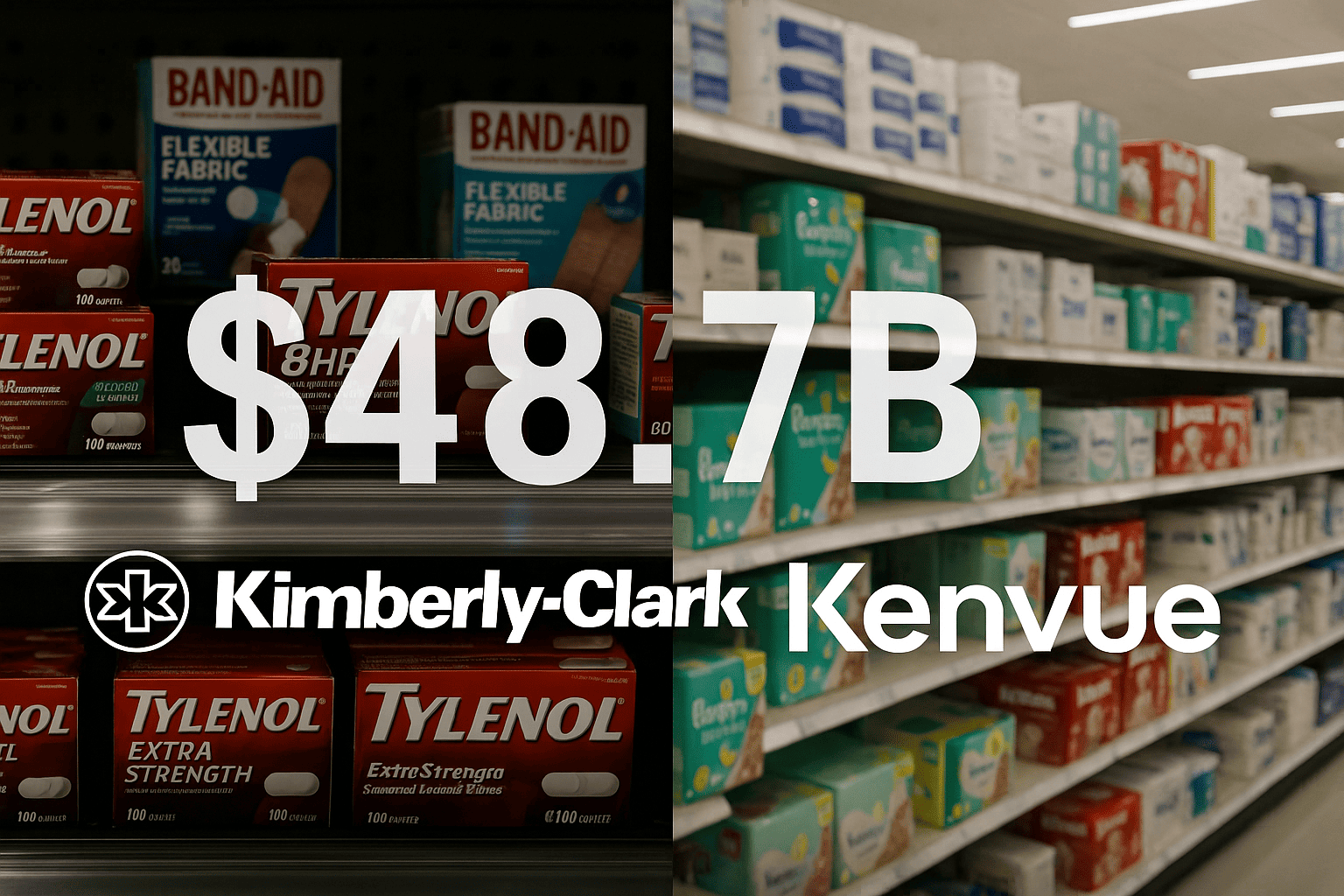

Kimberly-Clark Buys Kenvue in $48.7B Cash-Stock Deal

By Tredu.com • 11/3/2025

Tredu

What happened

Kimberly-Clark Buys Kenvue in $48.7B Cash-Stock Deal, a transaction that values Kenvue at $21.01 per share through a mix of cash and Kimberly-Clark stock. According to the companies and reporting by Reuters and AP, Kenvue holders are set to receive $3.50 in cash plus 0.14625 Kimberly-Clark shares per Kenvue share, implying a roughly 46 percent premium to the prior close. Boards must finalize approvals, and the parties guide to closing in the second half of 2026, subject to customary conditions and regulatory reviews.

Strategic logic and scale

The tie-up would create one of the largest consumer-health companies in the United States, pairing Kimberly-Clark’s tissue and baby-care franchises with Kenvue’s over-the-counter medicines and personal-care brands. Combined annual revenue is projected around $32 billion, with management highlighting cross-category reach, broader retail coverage, and potential to accelerate innovation pipelines. The buyer says operating synergies, procurement benefits, and overhead consolidation underpin the case for value creation, with multi-year cost savings forecast in the $1.9–$2.1 billion range.

Consideration mix and ownership

The deal uses a balanced cash-stock structure. Based on the illustrative exchange, Kimberly-Clark shareholders are expected to own about 54 percent of the combined company, Kenvue holders about 46 percent, at closing. Financing includes new debt and committed facilities, alongside the equity component, which helps manage leverage and ratings through the integration period. Market reaction was split at announcement, with Kenvue shares up and Kimberly-Clark shares down, a common pattern in large cash-stock acquisitions.

What Kenvue brings

Kenvue, the 2023 consumer-health spin from Johnson & Johnson, owns brands including Tylenol, Listerine, Band-Aid, Neutrogena, and Aveeno. As a stand-alone, Kenvue faced share-price pressure, leadership turnover, and a strategic review amid litigation overhangs. Activist interest also grew into 2025, pressuring management to explore options. The sale crystallizes a path that swaps public-market uncertainty for scale within a larger consumer platform.

Leadership and integration plan

Kimberly-Clark CEO Mike Hsu is slated to lead the combined group. Headquarters will remain aligned to Kimberly-Clark’s base, while Kenvue sites keep a significant presence to protect brand talent and supply. Integration will focus on category adjacency, retailer programs, and international routes to market, with near-term priorities around systems alignment, trade promotion harmonization, and inventory health. The companies target a three-year synergy capture window after close, a typical cadence for global branded-goods mergers.

Price, premium, and valuation context

At $21.01 per share, the consideration represents a premium of roughly 46 percent to Kenvue’s prior close cited in initial coverage. For Kimberly-Clark, the headline value is large relative to its own equity capitalization, which helps explain the selloff in early trading as investors weigh leverage, execution, and dividend priorities. The buyer argues category breadth and scale should support cash generation, while synergy delivery can de-risk multiples over time.

Financing, timing, and conditions

Reuters and other outlets reported that committed financing is in place, with the transaction targeted to close in the second half of 2026. Approvals will include antitrust clearances in key markets, standard merger filings, and any remedies that might be required in overlapping categories. The parties also disclosed reciprocal termination fees in press coverage, underscoring commitment to closing while acknowledging regulatory and market risks typical for deals of this size.

Risks investors will watch

Execution risk is front and center. Culture, systems, and supply chains must be combined without denting service levels to global retailers. Litigation considerations around legacy products remain a watch item, even if indemnities and reserves are in place, since perception can influence shelf space and pricing power. Synergy delivery depends on procurement contracts, network optimization, and disciplined brand investment; delays could push out the value-creation timetable. Debt markets and rate paths will shape the cost of carry until synergies arrive.

Why the market structure supports consolidation

Consumer-health categories rely on brand trust, regulatory compliance, and repetitive purchase habits. Scale can improve media efficiency, first-party retail data access, and shelf economics, which in turn can fund innovation and margin stability. Kenvue’s heritage in OTC medicines and skin care complements Kimberly-Clark’s strength in diapers, tissues, and paper-based personal care, allowing broader household baskets and coordinated promotions with large retailers. The combined route-to-market may also help in emerging markets where distribution density is a barrier for smaller players.

Where the headline fits in the bigger picture

Kimberly-Clark to Buy Kenvue for $48.7B appears after a year of portfolio reshaping across branded consumer goods, as companies trade non-core assets, pursue category adjacency, and lean on cost programs to defend earnings quality. For Kimberly-Clark, the acquisition shifts its mix toward higher-margin consumer health, while preserving scale in core paper-based categories. For Kenvue shareholders, the premium monetizes future restructuring upside today, with ongoing participation through the stock component.

Bottom line

The combination seeks durable scale in consumer health, backed by a clear synergy plan and a premium that brings Kenvue under Kimberly-Clark’s umbrella. Success will hinge on integration pace, litigation management, and steady cash generation that supports investment and deleveraging on the road to closing in 2026.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide. Discover proven strategies, risk management techniques, and market insights that will help you navigate the financial markets confidently and successfully.