OPEC+ Approves Modest October Oil Output Hike Amid Market-Share Offensive

By Tredu.com • 9/8/2025

Tredu

OPEC+ Approves Modest Output Increase to Regain Market Share

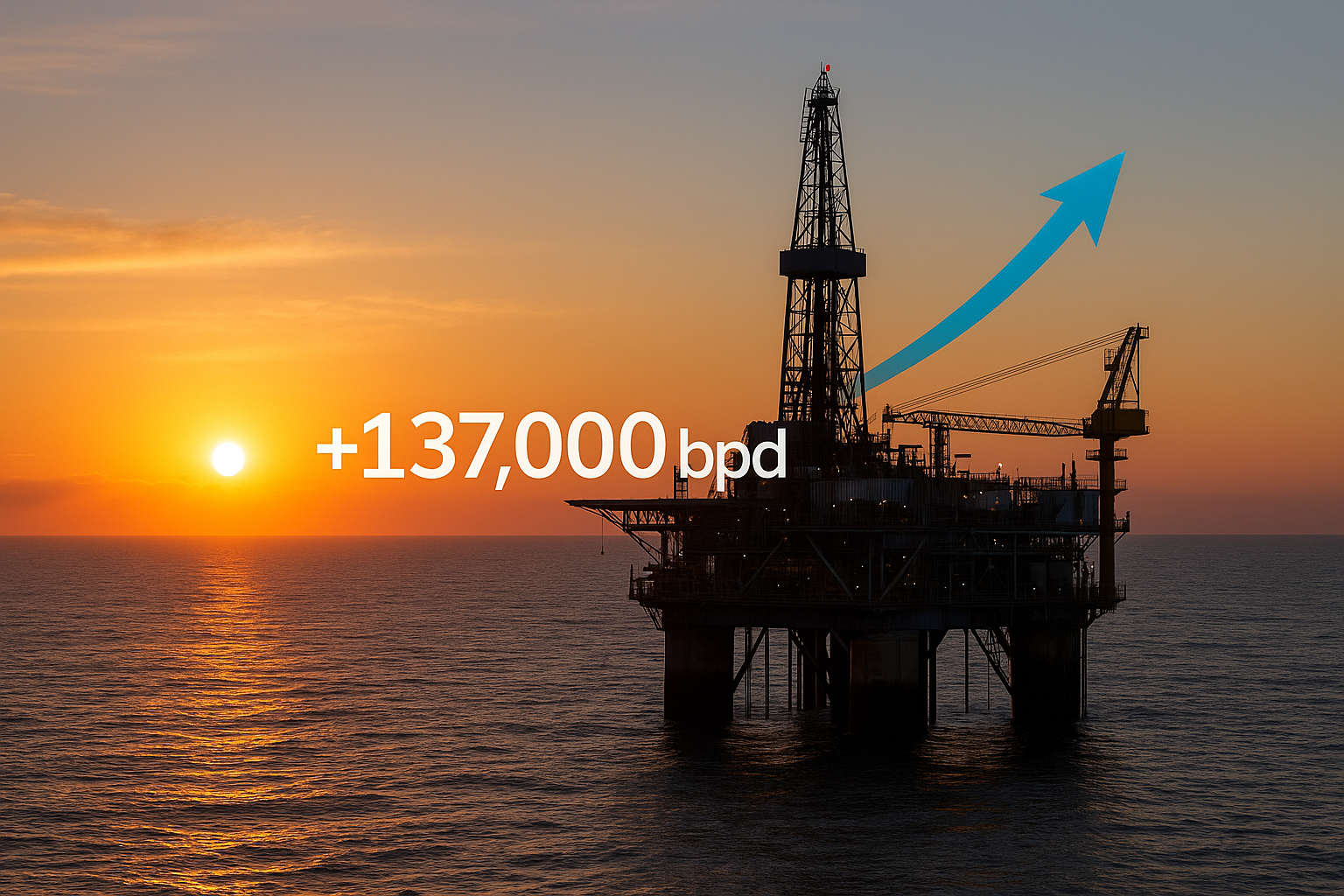

In a calculated pivot, OPEC+ approves a modest 137,000 barrels per day ( bpd) oil output hike starting in October, signaling a renewed focus on regaining global market share amid weakening demand. This decision marks a clear shift away from purely supporting prices toward a strategic emphasis on supply presence.

Largest Production Engines Lead the Renewed Supply Push

Saudi Arabia stands at the forefront of this decision, upping production from 9.07 million to 9.98 million bpd while preserving about 2.2 million bpd in spare capacity. In contrast, Russia’s ability to scale is constrained due to Western sanctions.

Decision Reflects Shift from Price Support to Market Presence

Unlike previous months, when output hikes were as high as 555,000 bpd in August and September and 411,000 bpd earlier this summer, this move is notably restrained. The lean increase underscores the group’s adaptation to signals of a global supply glut and subdued winter demand.

Analysts observe that while the volume may be modest, the message is loud: OPEC+ is reprioritizing market share over near-term price boosts.

Price Reaction Muted Amid External Pressure

Following the announcement, oil prices climbed modestly, Brent and U.S. WTI rose by roughly 0.3%–0.4%, recovering from prior sell-offs. The restrained price reaction highlights broader market dynamics, including fresh concerns over Russian supply and sanctions.

Geopolitics and Winter Demand Drive Calculated Restraint

The cautious increase emerges against a backdrop of geopolitical challenges and expectations for weaker demand during the Northern Hemisphere winter. Analysts warn that excess supply could tighten pressure on prices, especially with global inventory levels and U.S. shale output in focus.

Meanwhile, the move bolsters Saudi Arabia’s geopolitical posture, reinforcing leadership within OPEC+ and strengthening ties with the U.S., especially amid President Trump’s continued push for lower energy prices.

Strategy Reorientation to White-knuckle Market Conditions

This decision follows months of gradual relaxation of production cuts and heightened output in response to external pressure. With a second tranche of cuts (roughly 1.65 million bpd) being unwound ahead of schedule, OPEC+ is signaling readiness to adapt quickly if needed. A follow-up meeting is scheduled for October 5 to reassess the situation.

Global Market Implications and Future Risks

The restrained output boost sets the stage for a delicate balancing act. While global energy markets can absorb the modest uptick, seasonal slowdowns and overhang risks loom large. Futures markets may begin pricing in further adjustments, depending on evolving demand signals and geopolitical developments.

Conclusion

OPEC+ delivers a modest 137,000 bpd oil output hike for October, marking a strategic shift from price defense to market share expansion amid uncertain demand and geopolitical pressure. While production volumes are restrained, the market-share offensive is clear and calculated.