Trump Hails Japan, Signs Trade and Rare Earths Deals

By Tredu.com • 10/28/2025

Tredu

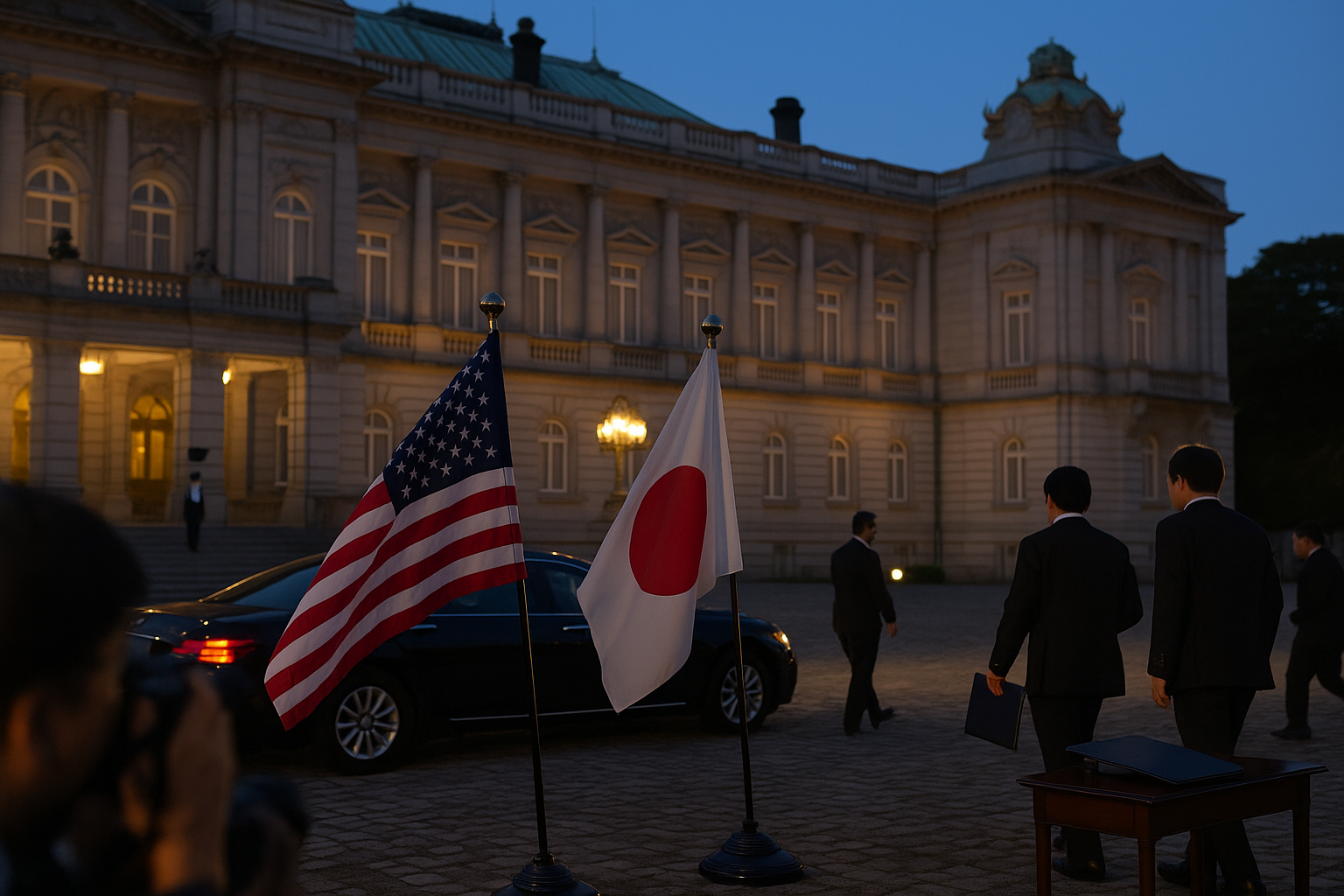

Warm optics, concrete agreements

During a high-profile Tokyo visit, President Donald Trump praised Japan’s new prime minister, Sanae Takaichi, and presided over the signing of accords on trade and rare-earths, positioning the alliance for tighter supply-chain coordination and lower tariff risk. Reuters and AP described an unusually warm public tone alongside policy substance, with leaders linking critical-minerals security to a broader economic framework.

The rare-earths and critical-minerals piece

The centerpiece is a rare-earths and critical-minerals agreement aimed at reducing reliance on Chinese exports. Reporting notes joint work on investment, processing, and market development, as well as coordination to lift capacity in allied jurisdictions. Images and dispatches from Tokyo show both leaders formalizing the accord as part of a wider economic-security agenda that includes nuclear-power and supply-chain resilience.

Trade track: the 15% tariff framework

The Tokyo beat also dovetails with a U.S.–Japan tariff framework that moves most Japanese imports to a baseline 15% U.S. tariff, down from higher punitive levels flagged earlier in the year. Prior orders and briefings describe lower duties on autos and a pledge to avoid volume caps, replacing uncertainty with a clearer baseline rate. Implementation steps were set out in public documents and confirmed by Reuters coverage.

Investment signals and alliance economics

Alongside tariffs and minerals, Japanese investment pledges into the United States have grown, with reports citing large headline figures tied to energy, critical materials, and technology supply chains. Analysts read the package as industrial policy by another name: tariff stabilization plus coordinated capital to backstop capacity for magnets, batteries, and key components. The choreography echoes prior cycles in which alliance economics and defense aims reinforced each other.

Political theater meets policy

Coverage emphasized a mix of stagecraft and policy. Trump lauded Takaichi, Japan’s first woman prime minister, as the two referenced shared security aims and a “golden age” in ties. Public moments included outreach to families of abductees and ceremonial gestures that recalled the Abe era. The tone supported the substantive agenda on rare-earths, nuclear, and tariffs, giving both leaders political room to proceed.

Why rare-earths matter now

Rare-earths and battery minerals sit at the center of EV, wind, smartphone, and defense supply chains. China’s dominance in processing has injected policy risk into prices and procurement. A bilateral accord can temper precautionary stocking, stabilize premia, and draw investment into alternative refining hubs. Execution remains the test; permitting, offtake contracts, and financing will determine whether rhetoric converts into tonnage and magnet output.

Markets and the week ahead

Markets typically respond to tariff de-escalation with relief in autos and industrials, while scarcity-themed miners can retrace when export-curb fears ease. Attention now shifts to the Trump–Xi summit, where a broader truce could extend the tariff framework beyond Japan and calm holiday-quarter logistics. If leaders codify milestones and enforcement, the policy path grows more durable; if not, risk premia can rebuild quickly.

The legal and practical runway

Public texts and reporting outline how the 15% baseline is implemented and where carve-outs apply, including automobiles and selected sectors. On minerals, watch for joint statements, procurement notices, and site announcements that anchor the deal in steel-and-concrete projects. Nuclear cooperation disclosures would further signal an energy-security layer to the alliance’s economic architecture.

Strategic lens: economics, energy, security

Linking trade normalization with rare-earths and nuclear capacity reflects a strategy that treats economic security as alliance core, not an adjunct. Japan has pledged to lift defense outlays toward 2% of GDP, while Washington seeks to re-shore or ally-shore critical inputs. The Tokyo accords fit that template: tariffs stabilize the commercial channel, minerals secure inputs, and energy underwrites future industrial capacity.

What to watch for confirmation

Three signposts will validate progress. First, full publication of legal text for the tariff framework and any sectoral annexes. Second, minerals project financing and offtake that prove the rare-earths accord has teeth. Third, statements from the Trump–Xi meeting that harmonize truce language with the Japan track. Clear deliverables would convert Tokyo’s optics into a policy step-change.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide. Discover proven strategies, risk management techniques, and market insights that will help you navigate the financial markets confidently and successfully.