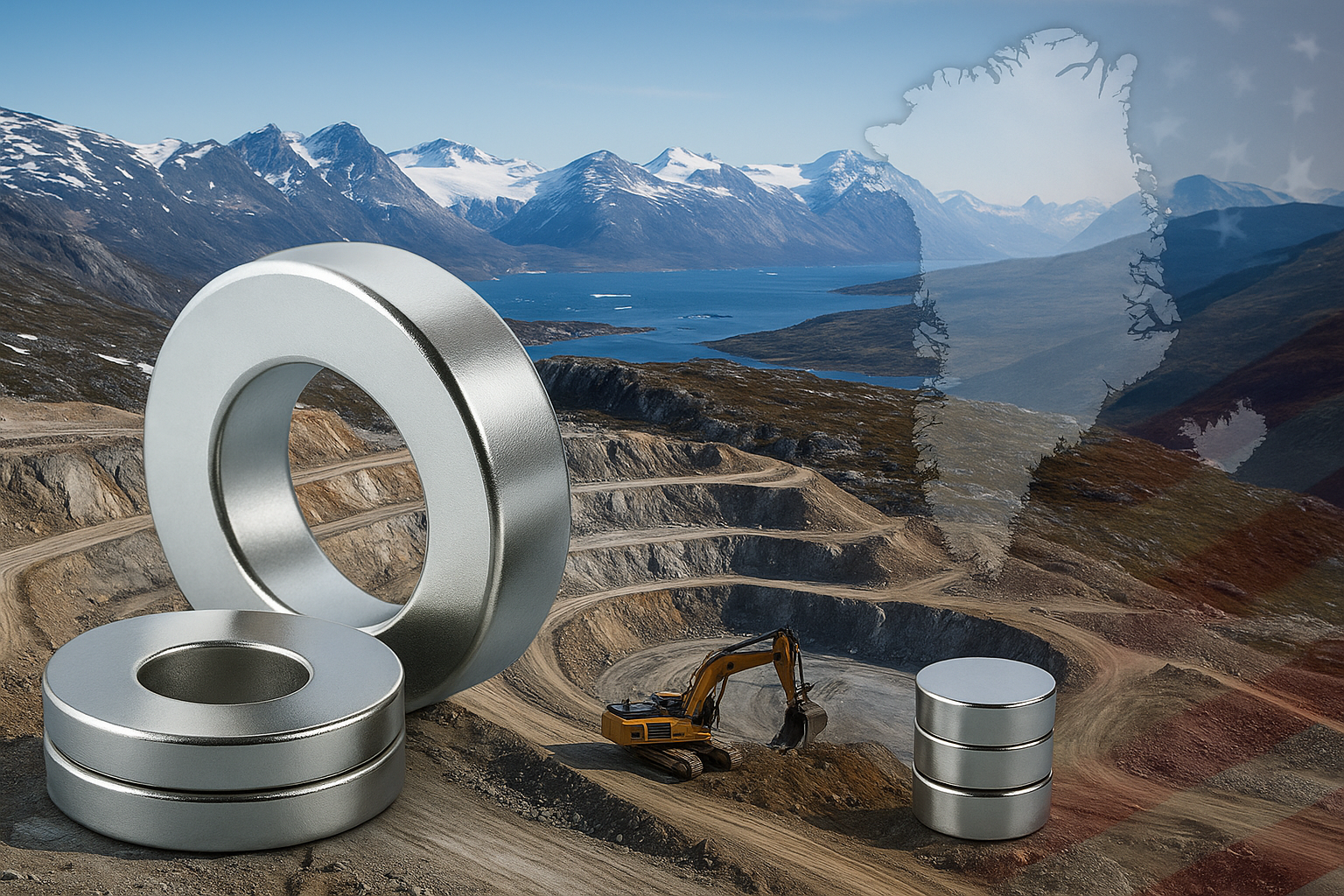

Critical Metals to Supply REalloys With Rare Earths From Greenland, Cementing U.S. Magnet Supply Chain

By Tredu.com • 10/8/2025

Tredu

Greenland Deal: Critical Metals Agrees Offtake with REalloys

Critical Metals (ticker CRML) announced it has signed a letter of intent to supply REalloys Inc. with rare earth concentrate from its Tanbreez project in Greenland. This offtake will represent up to 15 % of Tanbreez’s annual production, helping secure downstream demand for magnet materials in the U.S., a strategic win in the global critical minerals race.

The news fueled a jump in Critical Metals’ stock, with shares rising ~21% in morning trade.

REalloys is one of the few U.S. firms capable of processing rare earths into magnet-grade materials.

Strategic Context: Why This Deal Matters

Securing the U.S. Magnet Supply Chain

Rare earth magnets are vital for electric vehicles, wind turbines, defense systems, robotics, and aerospace. With China holding major dominance in rare earth processing, the U.S. has been striving to develop domestic supply chains. This offtake deal helps plug one gap: mine → magnet manufacturer linkage.

By anchoring demand via REalloys, Critical Metals is reducing midstream risk and helping ensure that Greenland production supports U.S. industrial goals.

Greenland: An Emerging Mining Frontier

The Tanbreez project is rapidly gaining attention. Critical Metals already secured rights to increase its stake in the project, up to 92.5 %.

Earlier, the U.S. Export-Import Bank (EXIM) had shown interest in providing a $120 million loan to fund development.

These moves tie into a broader push by Washington to reduce reliance on foreign, especially Chinese, dominance in rare earths and magnets.

Market Reaction, Risks & Future Catalysts

Market Reaction

Investors responded swiftly. The ~21% jump in CRML’s share price reflects optimism that the deal gives credibility and a clearer path to revenue.

This new offtake adds to earlier deals: Critical Metals had already clinched an offtake agreement with Ucore Rare Metals, which now covers nearly 25% of projected output.

Key Risks & Challenges

- Finalization & terms: The letter of intent must be converted into definitive agreements. Commercial terms, pricing, and conditions are still to be negotiated.

- Logistics & infrastructure: Greenland’s harsh climate, remote location, and minimal infrastructure pose challenges in mining, transport, and processing.

- Processing & purification: Moving from concentrate to magnet-grade rare earth oxides is technically complex and costly. REalloys’ facility strength is a positive, but scaling is nontrivial.

- Regulatory, environmental & community pushback: Greenland projects face scrutiny over environmental and sovereignty concerns.

- Capital & funding risk: Developing Tanbreez fully will require large capital outlays. Project financing, debt, or further government backing will be crucial.

Catalysts to Watch

- Agreement finalization & pricing terms between Critical Metals and REalloys.

- Offtake / supply ramp dates for the 15% allocation.

- Funding approvals, especially EXIM loan or U.S. government support.

- Production milestones at Tanbreez: start dates, throughput, grades.

- Additional downstream deals tying mine output to magnet / EV / defense clients.

This Greenland offtake deal is more than a supply contract, it’s an alignment of strategic, geopolitical, and industrial ambitions. Critical Metals anchoring rare earths to REalloys brings the U.S. one step closer to rebuilding a sovereign magnet supply chain.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide. Discover proven strategies, risk management techniques, and market insights that will help you navigate the financial markets confidently and successfully.