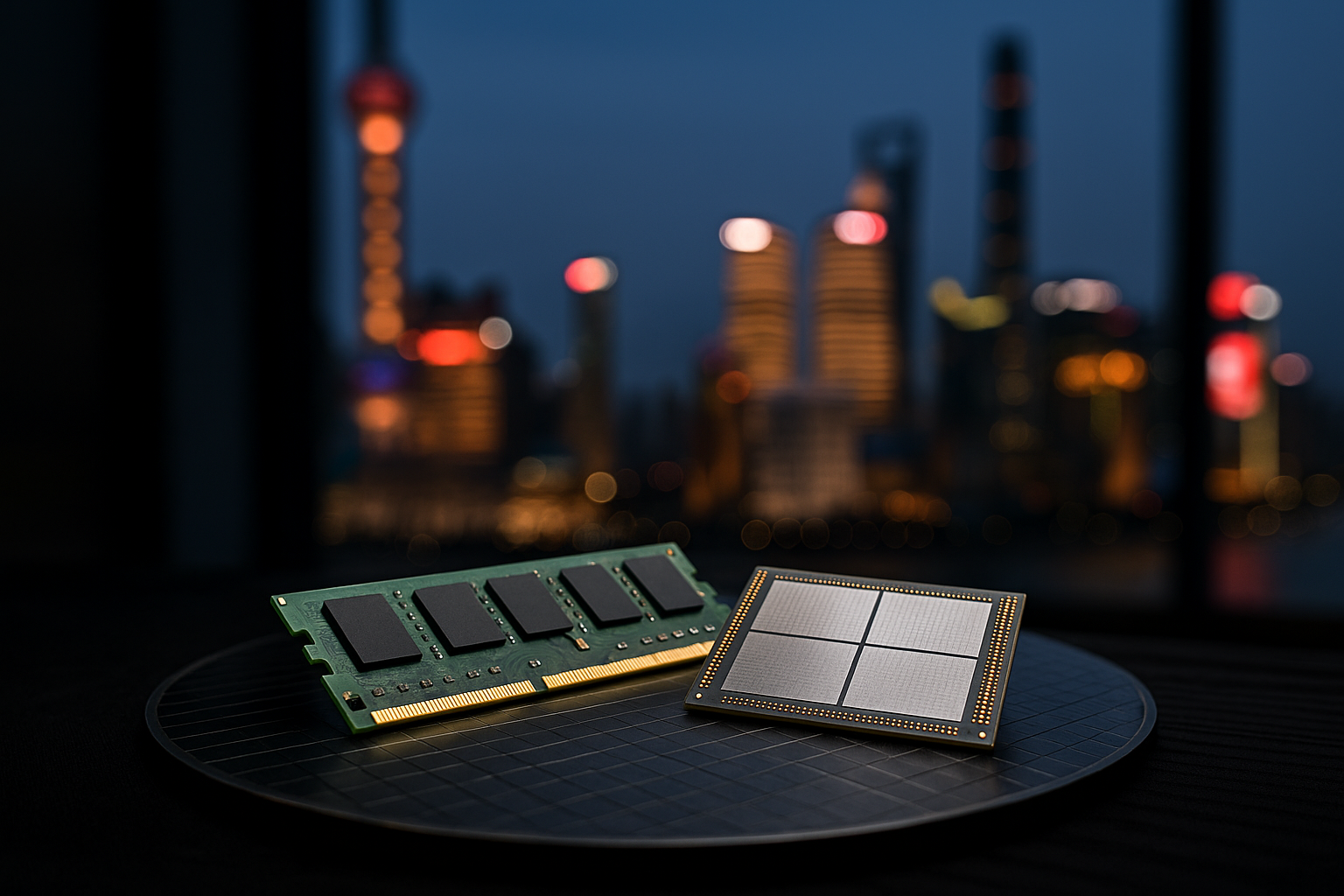

Chipmaker CXMT Plans Shanghai Listing With $42 Billion Valuation Amid China’s Chip Push

By Tredu.com • 10/21/2025

Tredu

What’s new and why it matters

China’s leading DRAM producer ChangXin Memory Technologies (CXMT) is preparing a Shanghai listing as soon as Q1 2026, aiming for a valuation of up to ¥300 billion (~$42 billion) and seeking to raise ¥20–40 billion to accelerate manufacturing scale-up. A preliminary prospectus could post by November, positioning the deal as one of the largest domestic tech floats in recent years and a flagship of Beijing’s semiconductor self-reliance drive.

The financing blueprint

Proceeds are expected to fund new lines for mainstream DRAM as well as advanced packaging and HBM-class memory, the high-bandwidth chips that feed AI accelerators and next-gen data centers. CXMT has stepped up capex over 2023–24 and is building out a packaging facility in Shanghai to tighten its local supply chain and reduce exposure to offshore bottlenecks.

HBM ambitions, and the gap to rivals

Sources indicate CXMT is investing toward HBM3 mass production by 2026, initially targeting ~30,000 wafers per month, roughly one-fifth of SK Hynix’s implied HBM capacity, while acknowledging a technology gap of up to four years versus leading Korean makers. Even so, domestic demand from hyperscalers and AI systems integrators provides a large captive market if export restrictions continue to constrain foreign supply.

Policy backdrop: self-sufficiency under pressure

Washington’s tighter controls on AI-related chips and HBM to China have amplified Beijing’s imperative to localize memory. Alongside CXMT’s DRAM push, peer YMTC has explored expansion paths into DRAM from its NAND base, underscoring a broader ecosystem attempt to fill strategic gaps across memory types. The CXMT IPO would be a litmus test of on-shore capital markets’ appetite to fund that transition at scale.

Market context: DRAM cycle meets AI build-out

The timing intersects two powerful cycles. First, a recovering DRAM market as inventories normalize; second, a secular ramp in AI infrastructure, where HBM content per accelerator has soared. If CXMT executes on yields and packaging, domestic customers could substitute a portion of imported memory with local supply, though qualification cycles and performance parity will be closely scrutinized by enterprise buyers. (Inference based on industry dynamics and reported HBM roadmap.)

What valuation implies

At up to $42 billion, CXMT would price as a national champion with outsized optionality tied to AI memory. The multiple bakes in:

- Capacity scaling toward competitive wafer starts;

- Node migration and binning yields that approach peers;

- Packaging maturity for HBM stacks.

Downside risks include slower yield learning, equipment access frictions, and export-control aftershocks that could affect tooling or EDA flows. (Valuation context inferred; roadmap items per reporting.)

Key risks and execution hurdles

- Technology catch-up: Compressing a multi-year gap in DRAM/HBM requires steep learning curves in lithography, etch, and advanced packaging.

- Tooling & ecosystem: Any new restrictions on equipment or software would complicate ramps.

- Customer qualification: Hyperscalers and server OEMs demand stringent reliability for HBM/DDR5; design-ins can be lengthy.

- Cycle sensitivity: DRAM remains cyclical; a demand air-pocket could pressure pricing right as new supply comes online. (Risk framing based on standard memory-cycle behavior.)

Strategic upside if it lands

If CXMT hits its milestones, China gains a scaled domestic provider across DDR5 and HBM, reducing exposure to foreign supply shocks and potentially seeding a homegrown AI compute stack with tighter vertical integration. For investors, on-track HBM ramps and solid DDR5 cash generation could validate the upper end of the proposed valuation over time. (Inference based on reported plan and policy aims.)

What to watch next

- Prospectus filing details (capex cadence, node roadmaps, yield targets).

- HBM pilot lines: timing of engineering samples and customer qualification updates.

- Policy signals in U.S.–China tech controls and any domestic incentives for memory fabs and packaging clusters.

- Peer moves: Korean and U.S. memory makers’ capacity plans; any YMTC steps into DRAM and how that affects local competition.

Bottom line

CXMT’s planned Shanghai IPO with a target valuation near $42 billion is both a financing event and a strategic marker in China’s chip push. Success hinges on translating capital into competitive DRAM and HBM output under a complex policy climate. Core theme: capital markets are being enlisted to narrow the memory gap, and the next two years will show whether scale and learning curves can do the heavy lifting.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide. Discover proven strategies, risk management techniques, and market insights that will help you navigate the financial markets confidently and successfully.