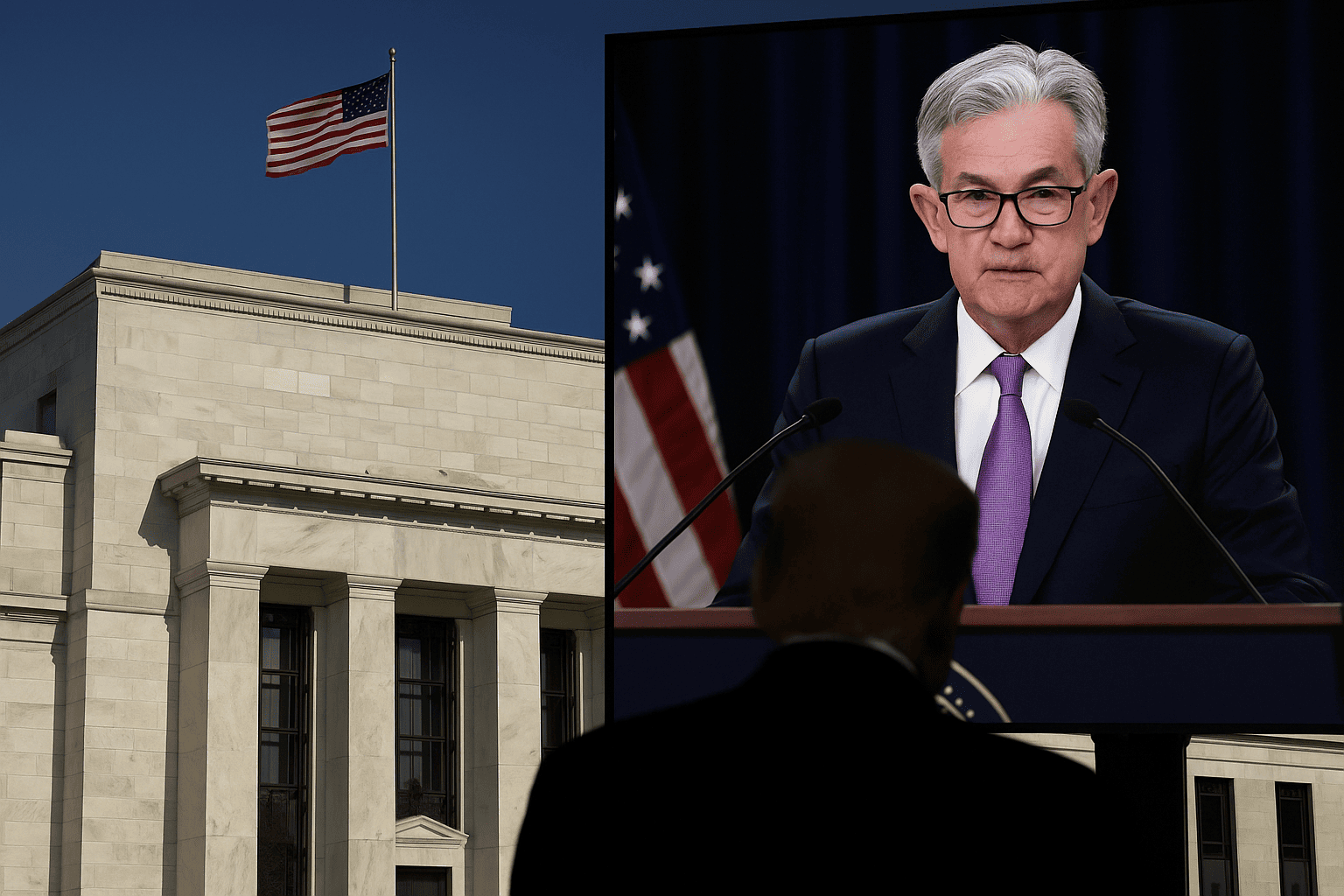

Fed Chair Succession Looms as Trump Pressures Powell

By Tredu.com • 11/21/2025

Tredu

What is happening

Political scrutiny of Jerome Powell has intensified, and attention is swinging toward the Federal Reserve chair succession. As the White House weighs personnel and policy priorities, investors are parsing what a change at the top would mean for the rates path, balance sheet policy, and supervision. The discussion is not only about who sits in the chair, it is about the alignment between the Board’s center of gravity and the administration’s growth and inflation goals. Markets tend to tolerate loud politics when the policy mix is predictable. They wobble when the leadership question is open and the macro backdrop is delicate.

Why it matters for markets

The chair sets the agenda, shapes consensus, and communicates the reaction function. A leadership pivot can add uncertainty to the terminal rate profile, the speed of balance sheet run-off, and the bar for future cuts or hikes. In practice, those variables translate directly into real yields, the dollar, and equity multiples. Credit spreads also respond, since banks and corporates reprice funding when they sense a shift in the Fed’s tolerance for inflation versus growth. Even if the broader Committee remains centrist, a new chair can tilt emphasis toward employment risks or price stability, which is enough to move curves.

Possible candidates and policy leanings

Names discussed by desks typically fall into three buckets: internal continuity candidates with long Board experience, regional bank presidents with strong macro credentials, and outside figures with prior policy or market roles. Continuity picks usually signal gradualism on rates, a measured balance sheet strategy, and steady supervision. Regional leaders can arrive with tested crisis playbooks and a focus on financial plumbing. External candidates might bring sharper views on regulation or on the interaction between fiscal deficits and term premia. For investors, the lens is simple, how would each profile weigh inflation risks versus labor slack, and how would that weighting filter into forward guidance.

Rates path scenarios

Three scenarios frame the debate. In a continuity case, the Committee keeps policy restrictive but edging toward neutral as inflation cools, with cuts paced carefully, data in the lead. In a cautious growth-first case, the bar for additional easing is lower if payrolls slow and vacancy rates fall further, which would shorten the period of above-neutral real rates. In a price-stability-first case, the bar for cuts rises, balance sheet run-off remains steady, and forward guidance stresses patience, which would hold real yields higher for longer. Each path carries different implications for duration and for sectors that trade like long-duration equities.

Dollar, bonds, and equities

Foreign exchange desks map the chair outcome to real yield differentials. A continuity chair with clear communications and a predictable glide path tends to compress risk premia, which can soften the dollar at the margin if global growth steadies. A more hawkish stance usually supports the dollar and flattens curves. In equities, stable guidance lifts multiples for quality growth and capital-light services, while a hawkish tilt favors cash-generative value and financials if curves steepen. Volatility rises in the interim, since options markets price the chance of a messaging misstep during the handover.

Bank regulation and supervision

The chair influences tone on capital, liquidity, and stress testing, working with the Vice Chair for Supervision. A continuity approach would keep methodical rulemaking and extended comment cycles. A more deregulatory posture might revisit elements of capital recalibration, broker-dealer liquidity, or resolution planning, which could ease pressure on returns for large banks but invite closer market scrutiny of risk controls. A tighter stance would reinforce conservative buffers, which supports stability but can dilute near-term profitability. Regional banks care about calibration as much as direction, since incremental changes in risk weights and operational risk add-ons move ROE math.

Communication style and market microstructure

Chairs differ in how they use press conferences, speeches, and the dots. A preference for plain language, minimal surprises, and small steps reduces volatility. Heavier reliance on qualitative guidance can work too, but only if it is consistent across meetings. Markets have learned to trade the sequencing, statement, projections, chair remarks, then Q&A. During a transition, the risk of mixed signals rises, so desks pay more attention to cross-checks from the Vice Chairs and key governors. Liquidity tends to be thinner around these events; small order imbalances travel farther, which is why spreads can widen even without fresh data.

Timeline and process

The process runs through formal nomination, hearings, and a Senate vote, with the incumbent continuing to serve until a successor is confirmed or reappointed. In parallel, the Committee meets on its regular schedule, and staff work on forecasts and implementation continues. Investors should expect more speculation than hard news until formal steps occur. The market’s risk is not the rumor, it is acting as if rumors are policy. The prudent posture is to map probabilities, not to anchor on any single outcome.

What could change the trajectory

Three signals would shift market odds. First, public comments from senior lawmakers on confirmation math, which often reveal bipartisan appetite for continuity or change. Second, trial-balloon policy speeches from potential candidates, especially on balance sheet strategy, real-time labor metrics, and inflation persistence. Third, fresh macro data that tighten or loosen the case for near-term cuts, since the incoming chair inherits the same economy the outgoing chair managed.

Strategy notes for allocators

Until personnel is clear, position sizing matters more than thematic conviction. Duration can be built in stages on softer inflation and labor prints, with protection against a temporary rise in real yields if rhetoric turns stricter. In equities, keep a core of quality balance sheets and free-cash-flow visibility, then add cyclicals on signs of broadening breadth. Financials benefit if curves steepen, but sensitivity to capital rules remains; hedges around key hearing dates can cap downside. The dollar view should track real yield spreads rather than headlines, since confirmation calendars move slower than tapes.

Bottom line

Leadership questions at the Federal Reserve are jumping from background to foreground. Markets can handle politics when the reaction function is predictable. They struggle when the chair is in flux and the data are mixed. Until the nomination path firms up, investors will anchor on the inflation and labor prints that drive the rates path, while treating personnel headlines as volatility, not as policy.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide. Discover proven strategies, risk management techniques, and market insights that will help you navigate the financial markets confidently and successfully.