Fintana Expands Educational Resources and Trading Infrastructure for CFD Traders

By Tredu.com • 12/4/2025

Tredu

November 2025 — Mauritius-based trading platform Fintana has outlined its comprehensive service offering in the Contracts for Difference (CFD) market, detailing its regulatory framework, educational initiatives, and technical infrastructure designed to serve traders across multiple asset classes.

Operating under license number GB23201338 with registration number 197666, Fintana maintains authorization from the Financial Services Commission of Mauritius. The platform currently provides access to over 160 tradable instruments spanning foreign exchange, cryptocurrencies, indices, equities, precious metals, and commodities.

Regulatory Framework and Operational Standards

The Financial Services Commission of Mauritius oversees Fintana's operations, requiring adherence to established financial regulations including client fund segregation protocols and negative balance protection measures. These regulatory requirements form part of the broader framework governing CFD providers in the jurisdiction.

According to information available on the company's legal documentation portal, Fintana maintains compliance with standards set forth by its regulatory authority. The platform operates with multilingual support spanning ten languages, including German, French, Italian, Spanish, Portuguese, Malay, Thai, Traditional Chinese, Simplified Chinese, and Arabic.

Educational Infrastructure Development

The platform has developed a structured educational curriculum addressing various experience levels within the trading community. The introductory segment comprises approximately 40 lessons distributed across eight course modules covering foundational trading concepts, terminology, Electronic Communication Networks, and platform-specific tutorials for MetaTrader software.

Advanced educational content includes specialized courses on trading tools, CFD and stock market mechanics, and strategic approaches to market participation. The platform's digital library contains eleven e-books addressing topics from market fundamentals to advanced technical analysis methodologies.

As CFD markets grow more complex, structured educational resources can help traders build a clear understanding of platform functionality, trading concepts, and the mechanics of various asset classes, supporting informed decision-making without implying potential profits:

- Explains how different asset classes (Forex, equities, commodities, indices, cryptocurrencies) function.

- Introduces fundamental and technical trading concepts relevant to CFD markets.

- Provides step-by-step guidance on using trading platforms and tools.

- Clarifies risk management principles and regulatory safeguards such as fund protection and leverage limits.

Offers reference materials, such as glossaries and analytical resources, for ongoing learning.

The education suite incorporates third-party analytical tools from Trading Central, a technical analysis provider established in 1999. This integration provides users with chart analysis, technical scoring systems, and market overview features through Trading Central's proprietary Panoramic View interface.

Market Context and Industry Trends

The global CFD market has experienced significant evolution in recent years, with regulatory bodies across multiple jurisdictions implementing enhanced consumer protection measures. According to industry research, demand for multi-asset trading platforms has increased as investors seek diversified exposure across traditional and digital asset classes.

Regulatory scrutiny of CFD providers has intensified internationally, with authorities focusing on leverage restrictions, client fund protection, and marketing practices.Platforms in the CFD industry have updated their operations to meet regulatory standards, focusing on clear compliance procedures and transparent reporting practices.

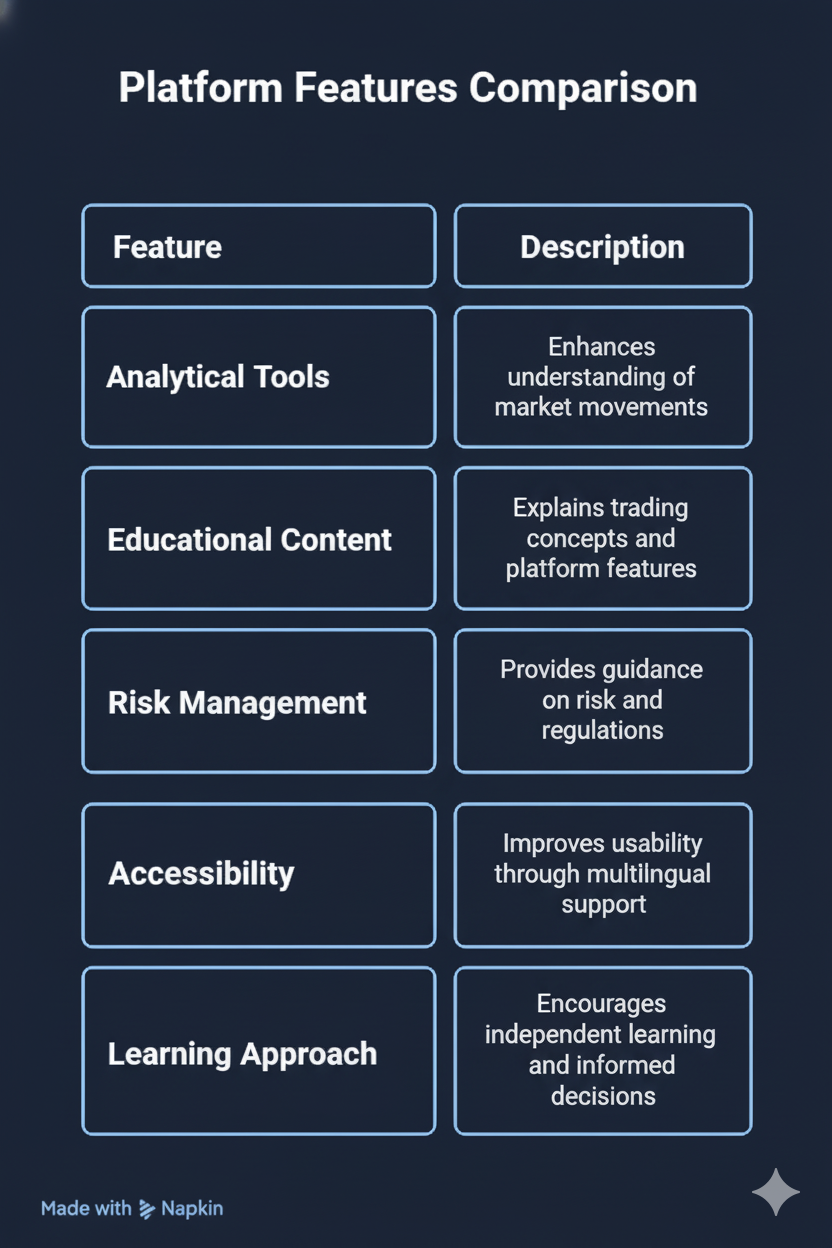

The combination of educational resources and analytical tools reflects a wider trend in the CFD industry to help traders make informed decisions. Platforms are focusing on providing practical resources, robust technical tools, and accessible support to improve the trading experience without implying potential profits:

- Enhances understanding of market movements through integrated analytical tools such as charts, indicators, and economic calendars.

- Provides structured educational content to explain trading concepts and platform features.

- Supports users with clear guidance on risk management and regulatory requirements.

- Improves accessibility and usability through multilingual support and responsive customer service.

- Encourages independent learning and informed decision-making rather than promoting specific outcomes.

Technical and Support Infrastructure

Fintana's WebTrader interface incorporates more than 30 technical indicators and multiple chart types designed to facilitate market analysis. The platform supports various deposit methods including credit and debit cards, wire transfers, and alternative payment methods, with withdrawals processed through credit cards, electronic wallets, and bank transfers.

Customer support operations function continuously through email and telephone channels. The platform maintains a demo account option enabling prospective users to evaluate functionality without capital commitment.

Third-party review aggregation on Trustpilot indicates customer feedback regarding response times and support team expertise, though individual experiences vary as typical in service-oriented industries.

Account Structure and Accessibility

The platform offers multiple account configurations designed to accommodate varying trader profiles and capital levels. Account types differ in minimum deposit requirements, available leverage ratios, and access to specific platform features, following standard industry practice for tiered service structures.

Documentation indicates that the onboarding process requires completion of personal detail verification, consistent with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulatory requirements applicable to financial service providers.

Market Analysis Tools

Beyond educational content, Fintana provides access to an economic calendar tracking scheduled releases of macroeconomic data, central bank announcements, and other market-moving events. Users can filter events by anticipated market impact and configure notifications for specific economic indicators.

Daily analysis videos and trading signals complement the analytical infrastructure, offering market commentary and technical perspectives. A glossary section serves as a reference resource for trading terminology and concept clarification.

Fintana’s platform is designed to provide retail CFD traders with access to advanced analytical tools and educational resources, supporting understanding of complex financial markets without suggesting potential profits:

| Feature | Description | |

| Charting & Analysis Tools | Offers charting tools, technical indicators, and market analysis features typically used in institutional trading. | |

| Tutorials & Educational Modules | Provides step-by-step tutorials and educational modules to explain trading strategies and platform functionality. | |

| Reference Materials | Includes glossaries, e-books, and video guides to support continuous learning. | |

| Market Evaluation Support | Helps traders evaluate market data and economic events to make informed decisions within their risk tolerance. | |

| Regulatory Compliance | Maintains a compliant structure with regulatory safeguards, such as fund segregation and leverage limits, to promote responsible trading. |

Conclusion

Fintana offers a structured and compliant CFD trading environment, emphasizing educational resources, multi-asset access, and adherence to the Financial Services Commission of Mauritius standards. Its integration of third-party analytics, multilingual support, and client protections like fund segregation and negative balance protection aligns with international best practices.

Fintana emphasizes transparency, accessible customer support, and a variety of account options, including demo accounts, to help users understand platform features and comply with regulatory requirements.

Prospective traders should still perform due diligence, assess educational resources, and consider their risk tolerance before engaging with leveraged instruments.

Risk Warning: Contracts for Difference (CFDs) are complex financial instruments that carry a high level of risk due to leverage. A significant percentage of retail investor accounts lose money when trading CFDs. Before engaging in CFD trading, individuals should carefully consider whether they understand how CFDs work and whether they can afford to take the high risk of losing their capital. Past performance is not indicative of future results. CFD trading may not be suitable for all investors, and independent financial advice should be sought where appropriate.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide. Discover proven strategies, risk management techniques, and market insights that will help you navigate the financial markets confidently and successfully.