FSCA-Licensed Broker Rolls Out Client Protection Framework

By Tredu.com • 12/4/2025

Tredu

November 2025 — AzurevistaFX (Pty) Ltd has commenced operations of its Riverquode trading platform under Financial Sector Conduct Authority (FSCA) supervision, implementing client safeguards that reflect international regulatory developments in retail Contract for Difference (CFD) provision. The platform operates under FSP license 52830 with CIPC registration number 2020/750823/07.

The launch follows a period of substantial regulatory evolution across major CFD markets, with authorities in Europe, Australia, and Asia implementing enhanced investor protection measures since 2018. South Africa's Twin Peaks regulatory model provides the framework within which the platform operates.

Client Protection Implementation

AzurevistaFX (Pty) Ltd has structured its operations around several core protective mechanisms mandated under FSCA oversight:

Implemented Safeguards:

- Negative balance protection across all account classifications

- Segregated client fund accounts separate from operational capital

- Margin call thresholds at 100% equity

- Stop-out levels set at 20% across all tiers

- Mandatory risk disclosures prior to account activation

These measures align with international regulatory frameworks designed to enhance retail investor safeguards. The European Securities and Markets Authority (ESMA) established similar protections across the European Economic Area in 2018, while Australia's ASIC implemented comparable requirements following comprehensive market reviews.Retry

Comparative Regulatory Frameworks

Global CFD regulation has undergone significant transformation since 2018, with authorities implementing intervention measures based on retail client outcome data:

| Jurisdiction | Key Measures | Implementation | |

| European Union (ESMA) | Leverage caps (1:30 major FX pairs), negative balance protection, margin close-out rules | 2018, made permanent 2019 | |

| Australia (ASIC) | Leverage restrictions, negative balance protection, target market determinations | 2021 | |

| Singapore (MAS) | Leverage limits, negative balance protection, enhanced disclosure | 2018 | |

| Cyprus (CySEC) | Capital adequacy increases, marketing restrictions, client fund protections | 2017-2020 | |

| South Africa (FSCA) | Conduct standards, segregation requirements, appropriateness assessments | Ongoing under Twin Peaks model |

The convergence of regulatory approaches reflects shared concerns regarding retail investor outcomes in leveraged derivative markets. South Africa's Twin Peaks structure separates market conduct oversight (FSCA) from prudential supervision (Prudential Authority), a model also employed in Australia, Netherlands, and the United Kingdom.

Leverage Parameters and Risk Management

Riverquode's leverage structure varies by instrument type, reflecting different risk profiles:

Platform Leverage Limits:

- Foreign exchange pairs: up to 1:400

- Metals and indices: up to 1:200

- Commodities: up to 1:200

- Equities: up to 1:5

- Cryptocurrencies: up to 1:5

These parameters differ from European limits where ESMA restricts major currency pair leverage to 1:30 for retail clients. The conservative approach to equity and cryptocurrency leverage aligns with global recognition of heightened volatility risks in these asset classes.

Regulatory Evolution Timeline

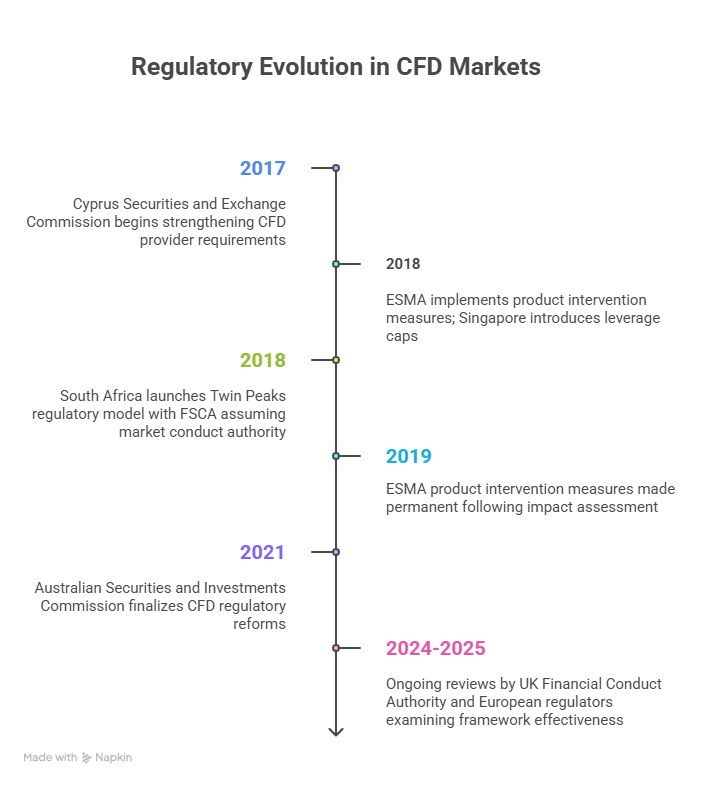

The past seven years have witnessed coordinated regulatory action across major CFD markets:

Educational and Transparency Requirements

Regulatory frameworks increasingly emphasize investor education alongside structural protections. Riverquode has developed educational infrastructure comprising:

- 40 video-based lessons across fundamental and advanced topics

- 11 downloadable e-books addressing trading mechanics and risk management

- Integration of third-party analytical tools from Trading Central

- Economic calendar with customizable event filtering

- Multilingual support in eight languages

The International Organization of Securities Commissions (IOSCO) has identified financial literacy as essential for informed participation in complex products. Multiple regulatory authorities now encourage or mandate educational resource provision by platforms.

Transparency requirements extend to fee disclosure, with platforms expected to clearly communicate all costs. Published spread structures enable client comparison across providers and understanding of transaction costs before account opening.

Industry Structural Changes

Regulatory intervention has reshaped the CFD provision landscape. Some platforms exited markets following leverage restriction implementation, while others adapted business models to comply with new standards. Marketing practices have undergone substantial modification, with restrictions on bonus offerings and promotional content.

Capital adequacy requirements have strengthened across jurisdictions, ensuring providers maintain sufficient resources to meet client obligations. Enhanced reporting enables regulators to monitor financial health and intervene when concerns emerge.

The competitive environment has shifted toward platforms emphasizing regulatory credibility and transparent operations rather than aggressive promotional strategies, reflecting industry maturation under regulatory pressure.

Conclusion

Riverquode's implementation of comprehensive client protection measures reflects the broader regulatory evolution transforming global CFD provision. The platform's negative balance protection, segregated account structures, and transparent operational framework align with international best practices emerging from sustained regulatory focus on retail investor protection.

Operating within South Africa's Twin Peaks regulatory model, AzurevistaFX (Pty) Ltd demonstrates how platforms are adapting to heightened oversight while maintaining market access for retail participants. The combination of structural protections, educational infrastructure, and regulatory compliance represents an approach increasingly expected by authorities across jurisdictions.

Risk Warning: CFDs are complex instruments carrying high risk due to leverage. A substantial percentage of retail accounts lose money trading CFDs. Individuals must assess whether they understand how CFDs function and whether they can afford potential capital loss. Past performance does not indicate future results. CFD trading may not suit all investors. Independent financial advice should be sought where appropriate.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide. Discover proven strategies, risk management techniques, and market insights that will help you navigate the financial markets confidently and successfully.