India Clears $40 Billion Rafale Order, Defense Stocks Reprice

By Tredu.com • 2/13/2026

Tredu

India’s $40 Billion Package Advances As New Delhi Clears Big-Ticket Buys

India on February 12, 2026 gave initial clearance for defense purchases totaling 3.6 trillion rupees, about $40 Billion, including additional Rafale fighter jets and Boeing P-8I aircraft. The step matters for markets because a program of this size influences defense Stocks, sovereign borrowing expectations, and risk sentiment tied to regional security.

The decision came through the Defense Acquisition Council, and it Moves the largest items into the next stage of technical and commercial talks. The move also Clears a near-term bottleneck for suppliers, even though final contract terms and delivery schedules still need to be negotiated.

Rafale Order Size Adds A New Earnings Catalyst For European Defense Names

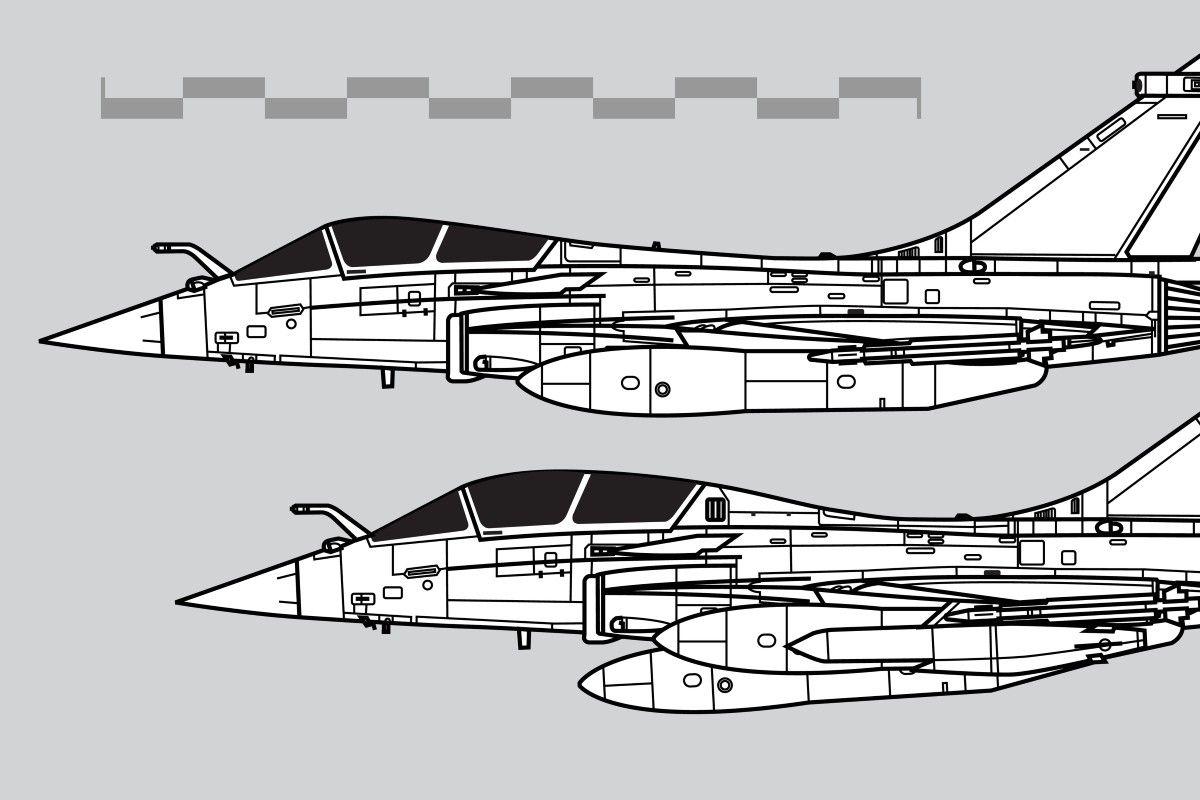

The centerpiece is the Rafale Order for the air force, which would expand a fleet that already includes 36 jets delivered by July 2022. Local media reported approval to pursue 114 Rafale jets, with a quoted value of about 3.25 trillion rupees, positioning the aircraft purchase as the dominant share of the $40 billion envelope.

For equities, the channel is straightforward: large government-to-government programs support multi-year backlog visibility for prime contractors and key subcontractors that supply engines, avionics, radars, and weapons integration. If negotiations progress smoothly, the Deal can lift valuation support for companies levered to fighter deliveries and upgrade work.

P-8I Aircraft And Anti-Tank Missiles Broaden The Supplier Impact

The package also includes Boeing P-8I reconnaissance aircraft for the navy, alongside anti-tank missiles for the army. That mix spreads the market effect beyond a single platform, adding demand signals for mission systems, sensors, and munitions.

The defense ministry also signed a separate contract to buy eight Dornier 228 aircraft for the coastguard. That additional purchase is smaller, but it provides an early indicator of follow-on work as the broader Upgrade cycle extends into surveillance and maritime domain roles.

Squadron Gap And Retirements Set A Hard Timing Constraint

India’s fighter squadron strength has dropped to 29, well below the 42 squadrons previously endorsed, creating a readiness constraint that affects procurement urgency. The MiG-21 was retired in September, and early variants of the MiG-29, Jaguar, and Mirage 2000 are approaching the end of service in coming years, adding a timeline pressure point that favors quicker contracting.

Those milestones matter for markets because compressed replacement windows tend to increase the probability of accelerated spending, which can shift government borrowing and defense sector earnings expectations within a single fiscal year.

Domestic Manufacturing Push Brings Local Winners Into Focus

New Delhi has been pushing more domestic manufacturing, and that policy direction changes how investors handicap the distribution of contract value. Hindustan Aeronautics has nearly 180 Tejas Mk-1A aircraft on order, but has not begun deliveries due to engine supply issues at GE Aerospace, a bottleneck that increases the importance of near-term imports for operational coverage.

If the procurement plan includes assembly or deeper local workshare for parts and maintenance, domestic industrials can benefit through long-duration service revenue. If local content requirements slow negotiations, delivery timing becomes a risk that can cap the initial equity reaction.

Macron Visit Adds A Diplomatic Trigger For Deal Momentum

The approvals come ahead of a visit by French President Emmanuel Macron to India next week, adding a political deadline that can accelerate technical decisions. Diplomatic sequencing often matters in defense procurement because pricing, financing terms, and industrial participation are frequently finalized at the leader level after staff work converges.

For investors, the window around the visit becomes a concrete calendar catalyst that can move defense Stocks in Paris and Mumbai, particularly if officials disclose negotiation milestones or outline a firm procurement schedule.

Markets Reprice Across Equities, FX, Rates, Credit, And Commodities

Defense spending at $40 Billion scale can influence India’s rates curve through expectations for gross issuance and fiscal allocation choices in 2026. If investors assume higher near-term outlays, yields can rise modestly at the long end, especially if spending coincides with slower tax receipts or higher subsidy costs.

In foreign exchange, larger imports of high-value platforms can increase dollar demand for milestone payments, while higher perceived security risk can also affect hedging activity. The net impact on the rupee depends on whether markets treat the spending as a stability premium or as a fiscal drag.

Credit spreads can also move. Contractors with exposure to long-duration government receivables typically benefit from improved order visibility, while banks and non-bank lenders can face small spread pressure if higher public borrowing tightens domestic liquidity.

Commodities respond indirectly. A broader military modernization cycle supports demand for specialty metals, electronics, and aviation fuels, although the main channel is risk sentiment: geopolitical tension can lift crude and gold, while reduced tail risk can do the reverse.

Base Case: Negotiations Begin, Contracts Land In Stages

Base case, the Defense Acquisition Council clearance transitions into technical evaluations and commercial bargaining, with signatures staged across 2026 rather than completed at once. A key trigger is whether detailed terms on weapons packages, maintenance, and training are finalized within the first half of 2026, enabling initial down payments without disrupting fiscal targets.

Under this path, European defense equities hold gains, Indian industrial names see selective support tied to workshare, and rates pricing reflects manageable, phased spending.

Upside Scenario: Faster Timeline Lifts Backlogs And Lowers Risk Premiums

Upside, the Rafale Order is finalized quickly with a clear delivery schedule and strong local support infrastructure, and additional naval purchases advance in parallel. The trigger would be an early announcement of contract structure and production ramp, allowing suppliers to book long-lead items sooner.

In that outcome, the Deal Lifts sentiment across European defense names, domestic suppliers gain visibility on service revenue, and the rupee benefits if investors interpret the spending as strengthening deterrence and lowering long-term risk premiums.

Downside Scenario: Delays, Cost Escalation, Or Local Content Friction

Downside, negotiations drag due to cost escalation, technology-transfer disputes, or constraints in the domestic production pipeline. Triggers include slippage tied to engine availability for Tejas, disagreements on weapons integration, or budget reprioritization that reduces the near-term cash portion of the $40B Upgrade.

That path increases volatility for defense Stocks, keeps borrowing expectations elevated for longer, and can pressure credit spreads if fiscal assumptions are revised during the next budget cycle.

Bottom line:

India’s clearance pushes a $40 billion modernization package into the negotiation phase, with fighter and maritime surveillance programs setting the pace. Markets will focus on delivery timelines, local manufacturing terms, and whether the spending profile stays compatible with fiscal and funding conditions.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide. Discover proven strategies, risk management techniques, and market insights that will help you navigate the financial markets confidently and successfully.