Skadeva Launches Multi-Asset Trading Platform with Regulatory Oversight

By Tredu.com • 12/4/2025

Tredu

November 2025 — Profit Pulse Ltd, operating under the brand name Skadeva, has officially launched its online trading platform, offering access to over 160 financial instruments across multiple asset classes. The platform, which went live under regulatory authorization from the Mwali International Services Authority (M.I.S.A.), provides trading services in forex, cryptocurrencies, indices, stocks, metals, and commodities.

The company holds license number BFX2024063 and is registered under number HT00324036 with the Mwali International Services Authority of Comoros Union. Skadeva's registered address is located on Bonovo Road, Fomboni Island of Moheli, Comoros Union.

Platform Infrastructure and Security Framework

Skadeva operates on SAS 70-certified infrastructure, implementing standard security protocols including transaction encryption and segregated client account structures. The platform supports multiple languages, including English, Japanese, Korean, and Hindi, reflecting its positioning for international markets.

The trading environment includes a WebTrader platform equipped with technical analysis tools, featuring over 30 technical indicators and customizable charting options. Users can execute trades through one-click order functionality across desktop and mobile-enabled devices.

Account Structure and Trading Conditions

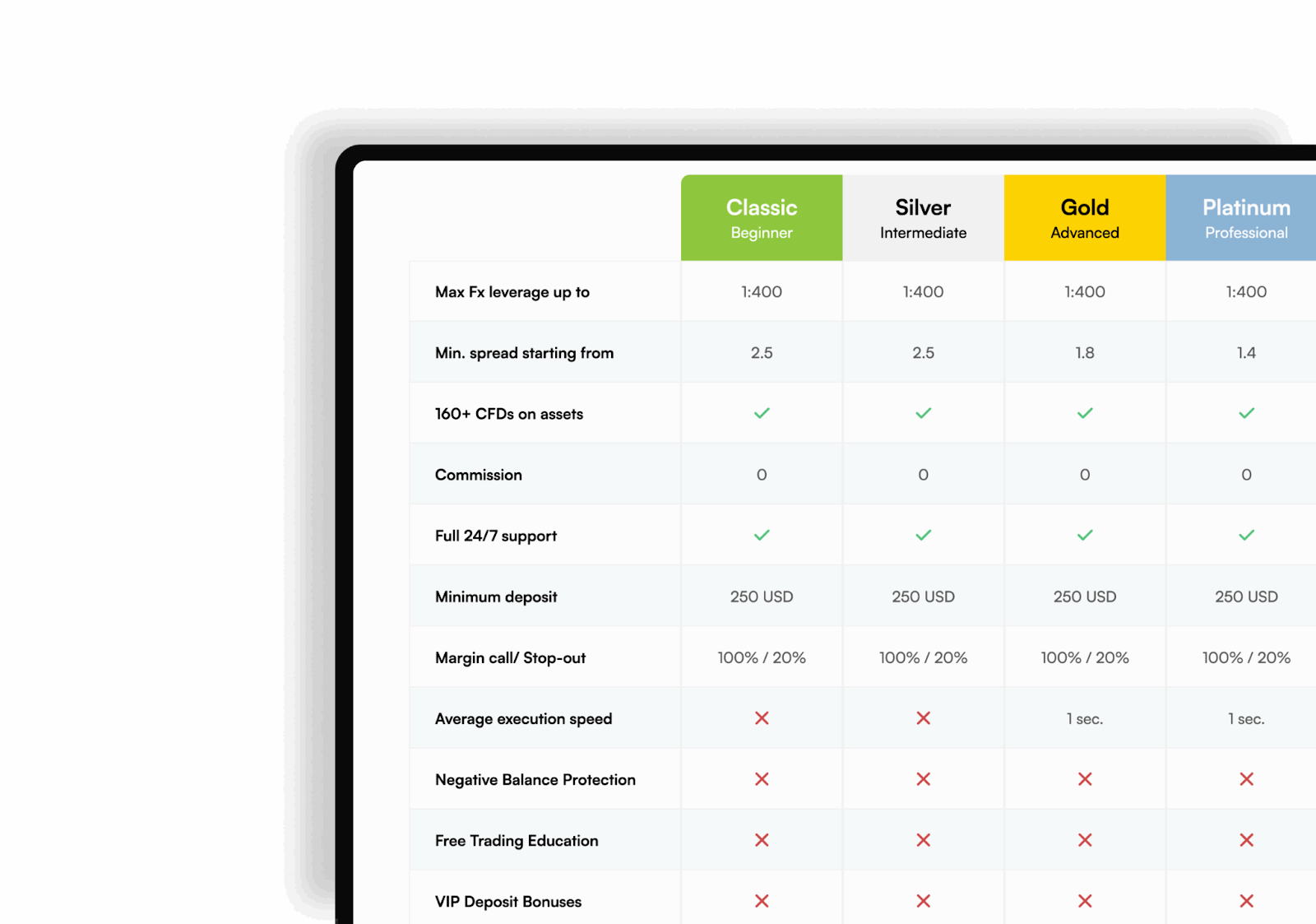

The platform offers five account tiers: Classic, Silver, Gold, Platinum, and VIP.

Key features across accounts include:

- Spread and swap structures: Each tier offers different spreads and swap discounts, while leverage ratios remain consistent across asset classes.

- Leverage limits:

- Forex: up to 1:400

- Metals, indices, commodities: up to 1:200

- Stocks & cryptocurrencies: up to 1:5

All account types include negative balance protection, a risk management feature designed to prevent client accounts from falling below zero balance. The platform sets margin call levels at 100% and stop-out levels at 20% across all account categories.

Minimum trade volumes begin at 0.01 lots, with maximum volumes capped at 50 lots per transaction. The company processes deposits through credit and debit cards, wire transfers, and alternative payment methods, while withdrawals are handled via credit cards, electronic wallets, and bank transfers

Educational Resources and Market Analysis Tools

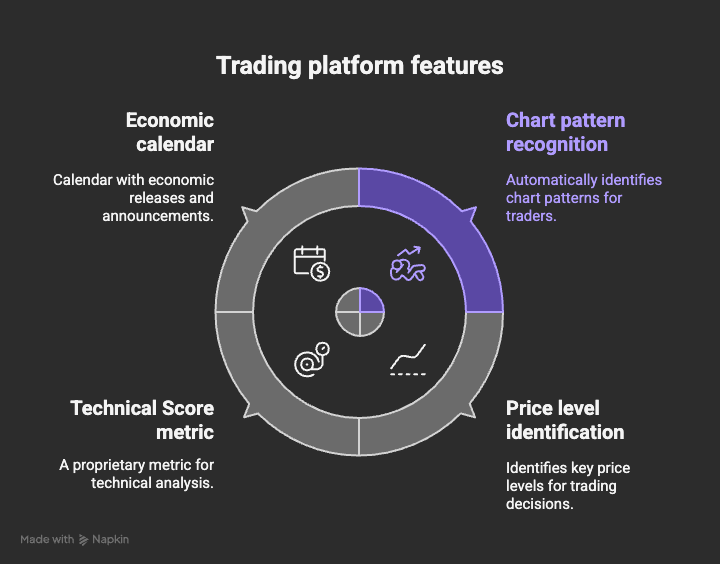

Skadeva has integrated Trading Central, a third-party analytical service established in 1999, directly into its platform. Key features include:

- Automated chart pattern recognition

- Price level identification

- Proprietary Technical Score metric

- Economic calendar with scheduled economic releases, central bank announcements, and macroeconomic indicators

The platform's education center contains structured learning materials organized into beginner and advanced categories. The curriculum includes video-based lessons covering trading fundamentals, platform tutorials for MetaTrader software, and modules on topics such as Electronic Communication Networks and capital management principles.

An electronic book library supplements the video content, addressing subjects ranging from basic market terminology to advanced technical analysis methodologies. The materials cover chart pattern recognition, trading psychology concepts, and various strategic approaches to market participation.

Market Context and Industry Developments

The online brokerage sector continues to expand globally, with regulatory frameworks varying significantly across jurisdictions. The Comoros Union, through the Mwali International Services Authority, represents one of several offshore regulatory bodies providing licensing services to financial services companies.

Industry data indicates growing participation in contracts for difference (CFD) trading, particularly in retail markets across Asia and Europe. The integration of cryptocurrency instruments into traditional trading platforms reflects broader market trends toward digital asset accessibility.

Multi-asset platforms have become increasingly common as retail traders seek consolidated access to diverse markets. The competitive landscape has driven broker differentiation through technology infrastructure, educational content, and customer service availability.

Customer Support Framework

Skadeva provides customer support services through email and telephone channels, with representatives available continuously. The support structure is designed to address account-related inquiries, technical platform issues, and general trading questions.

The company emphasizes its approach to transparency in client communications and states its commitment to addressing customer concerns through direct dialogue. Support services are available to all account holders regardless of tier level.

Regulatory Compliance Statement

As a licensed entity under the Mwali International Services Authority, Skadeva operates within the regulatory parameters established by that jurisdiction. The company maintains segregated accounts for client funds, separating operational capital from customer deposits as required by its licensing agreement.

The platform implements standard Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures consistent with international financial services practices. Account verification processes require documentation to confirm user identity before trading privileges are activated.

Risk Warning: Trading foreign exchange, contracts for difference (CFDs), and cryptocurrencies on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against traders as well as in their favor. The possibility exists that investors could sustain losses exceeding their initial investment. Before deciding to trade these products, individuals should carefully consider their investment objectives, level of experience, and risk tolerance. Past performance is not indicative of future results. Traders should only invest capital they can afford to lose and should seek independent financial advice if they have any doubts about the suitability of these products for their circumstances.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide. Discover proven strategies, risk management techniques, and market insights that will help you navigate the financial markets confidently and successfully.