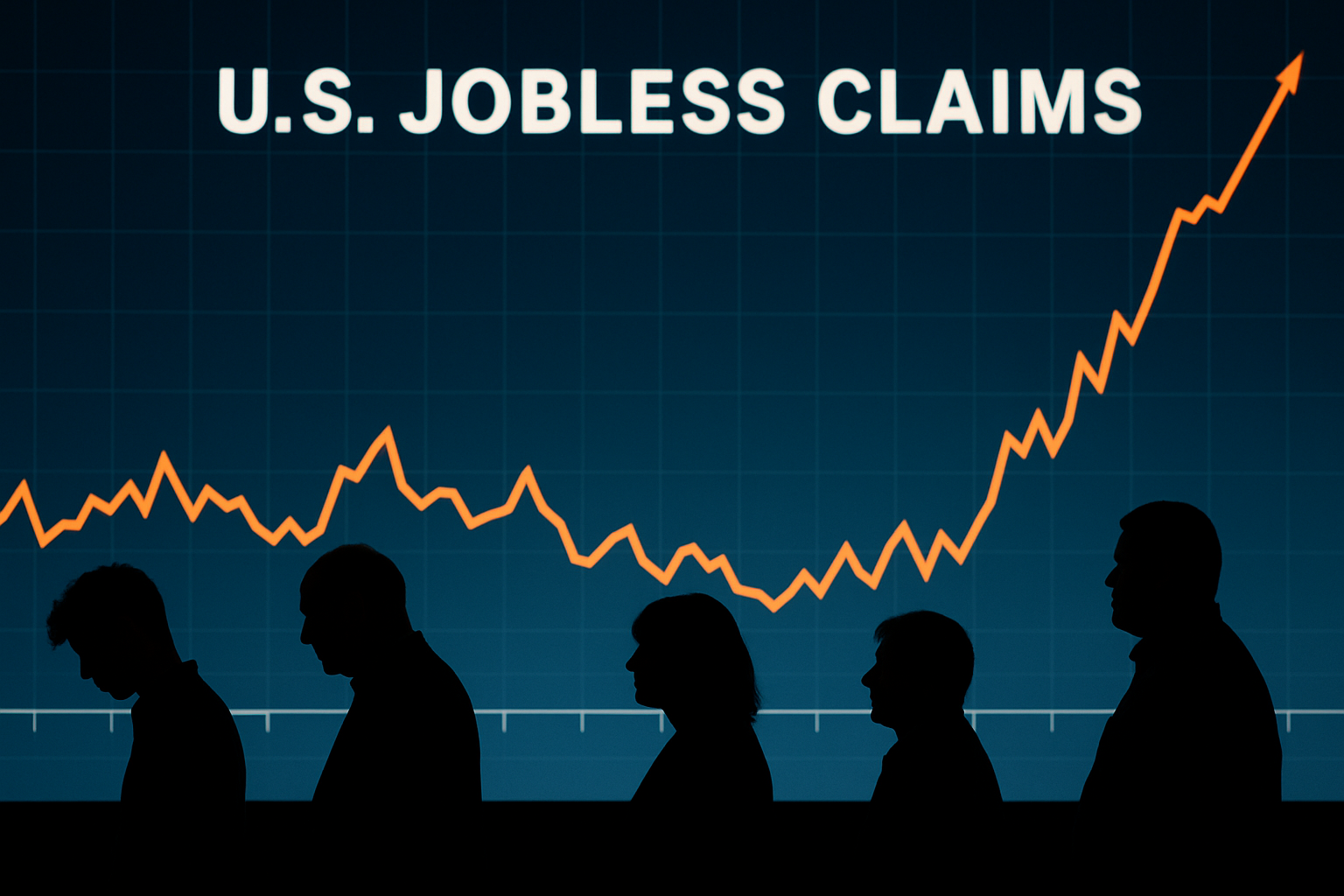

US Weekly Jobless Claims Tick Up Again as Shutdown Skews Signals, JPMorgan Estimates

By Tredu.com • 10/10/2025

Tredu

Claims Rise Again, But the Data Are “Unofficial”

U.S. weekly jobless claims increased to a seasonally adjusted ~235,000 for the week ended Oct. 4, 2025, up from ~224,000 a week earlier, according to JPMorgan’s compilation of state filings during the federal government shutdown. The continuing-claims tally edged up to ~1.927 million for the week ended Sept. 27, suggesting slower hiring and longer spells of unemployment. Because the Labor Department is not publishing regular releases during the shutdown, banks have reconstructed the series from state submissions, leaving markets to navigate with “best-effort” estimates.

The incremental rise follows a similar move the prior week, when private providers estimated initial claims around 224k and noted a modest uptrend from late September levels. While layoffs remain historically low, hiring has cooled, creating a “low-hire, low-fire” labor market that looks softer beneath the surface.

What’s Driving the Move?

Early Shutdown Effects

Economists attribute some of the increase to temporary layoffs among federal contractors and entities tied to halted government activity, an effect that also appeared during prior shutdowns. If the stoppage persists, claims could drift higher in the coming prints.

Cooling Demand for Labor

Beyond the shutdown, multiple indicators point to a cooler backdrop: continued claims near a four-year high, a lower job-openings-to-unemployed ratio, and slower hiring in interest-sensitive sectors. Private tallies for the last week of September already flagged ~224k initial claims and continued claims near 1.92–1.93m.

Policy, Trade & Technology Frictions

Analysts also cite trade and immigration policies and the adoption of AI as factors reshaping labor demand, contributing to slower net hiring even as outright layoffs stay contained.

Markets: Reading “Blurred” Labor Signals

With official BLS releases paused, investors are leaning on bank reconstructions and third-party databases. The near-term read-through:

- Rates & Fed path: A gradual rise in claims alongside subdued inflation would typically support further easing, but policymakers will be cautious given the data fog and still-resilient consumer demand. Comments from Fed officials already acknowledge a softer labor backdrop.

- Equities: Cyclicals tend to underperform if claims trend higher, though the market reaction is muted when the rise is viewed as shutdown-distorted rather than cyclical deterioration.

- Dollar & credit: A slower labor market can weigh on the dollar at the margin while supporting duration; credit spreads could drift wider if continuing claims keep grinding up.

How This Compares to Recent History

Private estimates show claims well below the 263k spike recorded in early September on official data, but the level has clearly firmed from the summer’s troughs. The recent trend, higher than the lows, lower than prior spikes, aligns with a slow-cooling labor narrative.

Similarly, continuing claims near ~1.93m are elevated versus 2024 but shy of recessionary territory, reinforcing the idea that turnover has slowed even as broad-based layoffs remain limited.

Sector Lens: Who’s Most Exposed?

- Government-adjacent & contractors: Most directly affected by the shutdown through delayed payments and furloughs; claims can rise quickly but also unwind when operations resume.

- Interest-sensitive pockets: Construction, real estate services, and durable goods are vulnerable if financing costs remain high.

- Tech & business services: Hiring plans have normalized after 2021–22 surges; some firms are using attrition and slower backfills rather than layoffs to manage costs.

What to Watch Next

- Shutdown duration: A quick resolution could cap further increases in claims; a protracted impasse risks a higher plateau.

- Backlog effects: When the shutdown ends, catch-up reporting could introduce volatility in the official series (both initial and continuing claims).

- Continuing claims trend: Persistent prints >1.9m would signal mounting difficulty in finding new jobs, a late-cycle hallmark.

- Next official labor data: Once releases resume, reconcile bank estimates with BLS to gauge true momentum; September’s delayed employment report will be pivotal for the Fed and markets.

Investor Playbook (Not Investment Advice)

- Duration tilt: Gradual labor softening supports a modest duration bias, particularly if inflation data stay contained.

- Quality factor in equities: Favor quality balance sheets and defensive cash-flow generators until claims stabilize.

- Credit risk management: Maintain selectivity; rising continuing claims can pressure lower-quality credit.

- Data-dependent stance: Treat incoming (unofficial) claims and alternative trackers as directional, not definitive, until official publication resumes.

Bottom Line

US jobless claims rose again to ~235k even as layoffs remain historically low, but continuing claims near ~1.93m point to a labor market that’s cooling rather than cracking. With the government shutdown obscuring official signals, investors should focus on trends, not a single print. Until full data visibility returns, the core theme holds: a low-hire, low-fire market gliding toward softer conditions.

How to Trade Like a Pro

Unlock the secrets of professional trading with our comprehensive guide.